FANNIE MAE, Sales of LIHTC and Section 8 Properties, Sept 2017 Summary

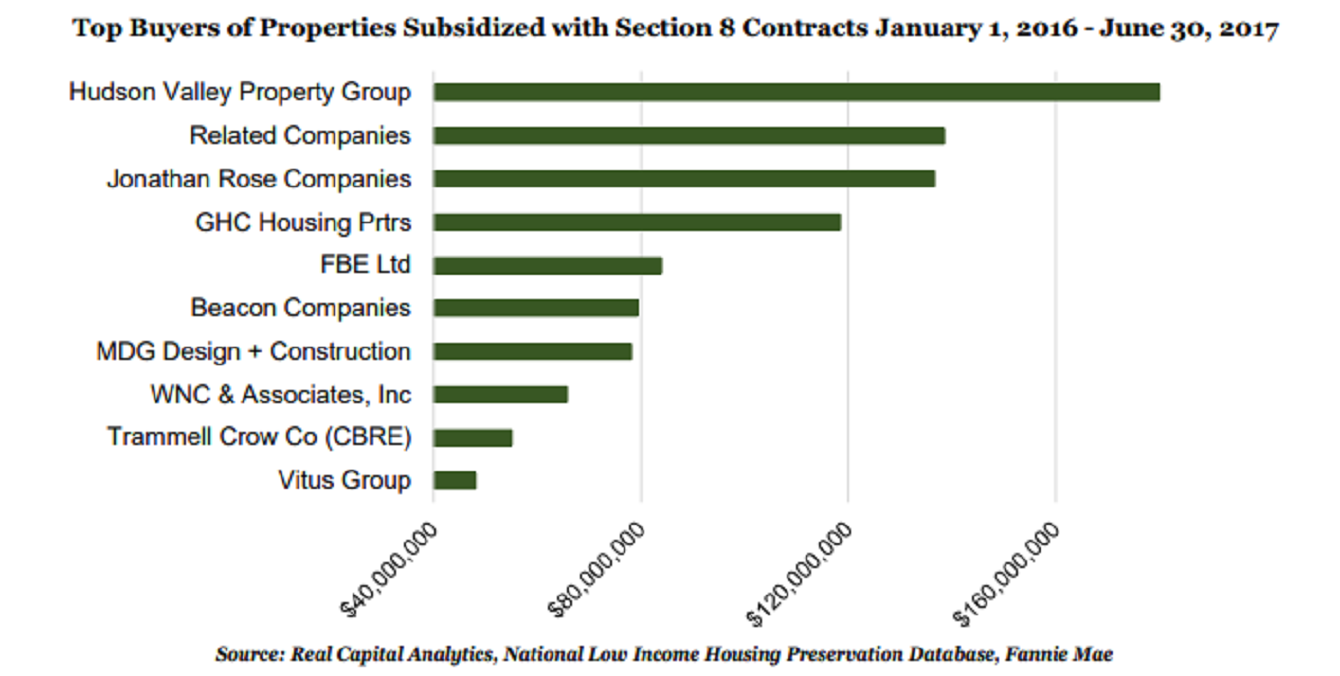

As shown in the chart above, the top investor in properties subsidized with Section 8 contracts over the past

18 months was the Hudson Valley Property Group (HVPG), a New York City–based affordable housing

preservation firm. HPVG acquired a portfolio of seven properties located across Northern New Jersey, thereby

preserving over 1,000 units of affordable housing in a higher housing cost market. Walker & Dunlop arranged

the financing for the $181 million acquisition by a joint venture of Hudson Valley Property Group LLC, Red

Stone Companies LLC, and Wheelock Street Capital by securing $144 million in financing from Fannie Mae.

With the properties having been built between 1979 and 1983, HPVG plans extensive renovations despite

keeping the units affordable.

…

Project-Based Section 8 Property Sales

While sales of properties subsidized with Project-Based Section 8 contracts reached a high of $2.4 billion in

2016, since 2012 sales have generally totaled between $1.5 and $2.0 billion annually. Through the first half of

2017, sales of Section 8 properties totaled an estimated 1.2 billion, making it possible that 2017 sales will match

2016’s peak.